What They Mean When They Talk About Tax Hikes On The Rich

Increase Taxes On The Rich - What that means

There is a tremendous amount of innumeracy in this country. I don't know why that is.

One thing I keep seeing is talk of tax hikes on those making more that $250k. I want to describe what that means.

First, technically, it is an increase of tax rate on incremental (marginal) income above $250k. It's not simply raising the rates on everyone making more than $250k. It may have that effect, but the distinction is important.

What is the distinction?

Consider a person who makes $1.01 less than $250k. He or she will pay let's say $50k in income tax. If he makes $1 more, he will pay about $0.30 more taxes at a 30% income tax rate.

Now let's say that the tax laws change so that income above $250k is taxed at 40% (up from 30%). It does not mean that suddenly his entire income is multiplied by 40%, it means that only the amount above $250k will be multiplied by 40%.

So let's say our $249,999 earner gets a raise to $260k. Under a 30% rate, his tax would increase about $3,000, so his net goes up by $7,000. Under a 40% rate, his tax would go up by $4,000, so his net is $6,000 higher.

Look, I'd rather pay less in taxes, but we as a nation need to work down the deficit. Doing it by taxing high earners more really makes a lot of sense, and you know what, that $1,000 will not even make a dent in Mr. 260k. For a $10k increase in salary, his total taxes go from $50k to $54k instead of $53k.

An Alternate Scenario

Let's try another scenario to see why that all matters. Drop taxes on the first $250k, raise taxes above that.

In the above example, our $260k guy paid an average 20% rate on the first $250k, then 30% for money above that. His taxes would be $53k.

Now suppose you were to drop the rate on the first $250k to 16%, then at the same time increase the rate above $250k to 40%. What would be the impact then?

On the first $250k, he would pay $40k, then on the next 10k he would pay $4k, for a total of $44k.

This is similar in form to what President Obama has been proposing. The press has distorted the actual implications to make it sound like a big tax increase. That is simply not the case.

The table below shows the differences:

"As Is" Raise Tax above 250k Tax below 250k=16%

20%, 30% to 40% Above 250k = 40%

First 250 k 50k 50k 40k

Next 10 k 3k 4k 4k

Total 53k 54k 44k

So you can see that lowering taxes on income less than $250k and raising them on income above $250k actually lowers taxes even on some people making more than $250k. In the example above, a high earner would begin paying more taxes at $350k compared to the As Is case.

So you can see that lowering taxes on income less than $250k and raising them on income above $250k actually lowers taxes even on some people making more than $250k. In the example above, a high earner would begin paying more taxes at $350k compared to the As Is case.

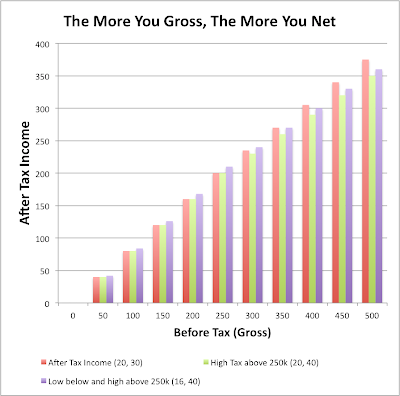

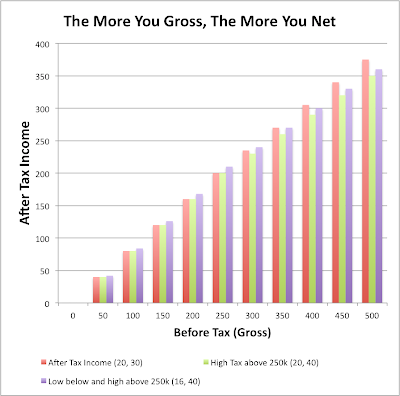

Here is what it looks like graphically:

Note that the more you make gross (x-axis, the more you make net in all three cases. If the tax is raised only on the high earners (green), you net more at all income levels than not earning the extra money. However you net less than the other cases.

And zoomed in on the region above 250k. Green is less than the other two, but something interesting happens in comparing red and purple. From 250 to 350 k gross, purple with a higher tax rate on income above 250k actually yields more net than the As-Is case. That's because the higher rates on income above 250k is offset by lower rates above 250k. Purple and red are equal at 350k, then red nets more than purple.

So if rates on lower income are dropped, while rate on higher income are increased, will that hurt high income people and create a disincentive to work?

At 500k gross, there's about a 15k difference in net income. The person who earns 500k per year takes home 360 instead of 375k.

Conclusion

I am not putting a value judgment here on what is good or bad, I just want to encourage people to look at and understand these issues. Headlines and sound bites simply do not do justice to the complexity of these issues.

There is a tremendous amount of innumeracy in this country. I don't know why that is.

One thing I keep seeing is talk of tax hikes on those making more that $250k. I want to describe what that means.

First, technically, it is an increase of tax rate on incremental (marginal) income above $250k. It's not simply raising the rates on everyone making more than $250k. It may have that effect, but the distinction is important.

What is the distinction?

Consider a person who makes $1.01 less than $250k. He or she will pay let's say $50k in income tax. If he makes $1 more, he will pay about $0.30 more taxes at a 30% income tax rate.

Now let's say that the tax laws change so that income above $250k is taxed at 40% (up from 30%). It does not mean that suddenly his entire income is multiplied by 40%, it means that only the amount above $250k will be multiplied by 40%.

So let's say our $249,999 earner gets a raise to $260k. Under a 30% rate, his tax would increase about $3,000, so his net goes up by $7,000. Under a 40% rate, his tax would go up by $4,000, so his net is $6,000 higher.

Look, I'd rather pay less in taxes, but we as a nation need to work down the deficit. Doing it by taxing high earners more really makes a lot of sense, and you know what, that $1,000 will not even make a dent in Mr. 260k. For a $10k increase in salary, his total taxes go from $50k to $54k instead of $53k.

An Alternate Scenario

Let's try another scenario to see why that all matters. Drop taxes on the first $250k, raise taxes above that.

In the above example, our $260k guy paid an average 20% rate on the first $250k, then 30% for money above that. His taxes would be $53k.

Now suppose you were to drop the rate on the first $250k to 16%, then at the same time increase the rate above $250k to 40%. What would be the impact then?

On the first $250k, he would pay $40k, then on the next 10k he would pay $4k, for a total of $44k.

This is similar in form to what President Obama has been proposing. The press has distorted the actual implications to make it sound like a big tax increase. That is simply not the case.

The table below shows the differences:

"As Is" Raise Tax above 250k Tax below 250k=16%

20%, 30% to 40% Above 250k = 40%

First 250 k 50k 50k 40k

Next 10 k 3k 4k 4k

Total 53k 54k 44k

So you can see that lowering taxes on income less than $250k and raising them on income above $250k actually lowers taxes even on some people making more than $250k. In the example above, a high earner would begin paying more taxes at $350k compared to the As Is case.

So you can see that lowering taxes on income less than $250k and raising them on income above $250k actually lowers taxes even on some people making more than $250k. In the example above, a high earner would begin paying more taxes at $350k compared to the As Is case.Here is what it looks like graphically:

Note that the more you make gross (x-axis, the more you make net in all three cases. If the tax is raised only on the high earners (green), you net more at all income levels than not earning the extra money. However you net less than the other cases.

And zoomed in on the region above 250k. Green is less than the other two, but something interesting happens in comparing red and purple. From 250 to 350 k gross, purple with a higher tax rate on income above 250k actually yields more net than the As-Is case. That's because the higher rates on income above 250k is offset by lower rates above 250k. Purple and red are equal at 350k, then red nets more than purple.

So if rates on lower income are dropped, while rate on higher income are increased, will that hurt high income people and create a disincentive to work?

At 500k gross, there's about a 15k difference in net income. The person who earns 500k per year takes home 360 instead of 375k.

Conclusion

I am not putting a value judgment here on what is good or bad, I just want to encourage people to look at and understand these issues. Headlines and sound bites simply do not do justice to the complexity of these issues.